(f) Phaseout of marriage penalty in 15-percent bracket adjustments in tax tables so that inflation will not result in tax increases. Taxable under this subsection a tax determined in accordance with the following table: There is hereby imposed on the taxable income of. There is hereby imposed on the taxable income of every married individual (as defined in section 7703) who does not make a single return jointly with his spouse under section 6013, a tax determined in accordance with the following table: (d) Married individuals filing separate returns. There is hereby imposed on the taxable income of every individual (other than a surviving spouse as defined in section 2(a) or the head of a household as defined in section 2(b)) who is not a married individual (as defined in section 7703) a tax determined in accordance with the following table: (c) Unmarried individuals (other than surviving spouses and heads of households). There is hereby imposed on the taxable income of every head of a household (as defined in section 2(b)) a tax determined in accordance with the following table: (2) every surviving spouse (as defined in section 2(a)), a tax determined in accordance with the following table: (1) every married individual (as defined in section 7703) who makes a single return jointly with his spouse under section 6013, and

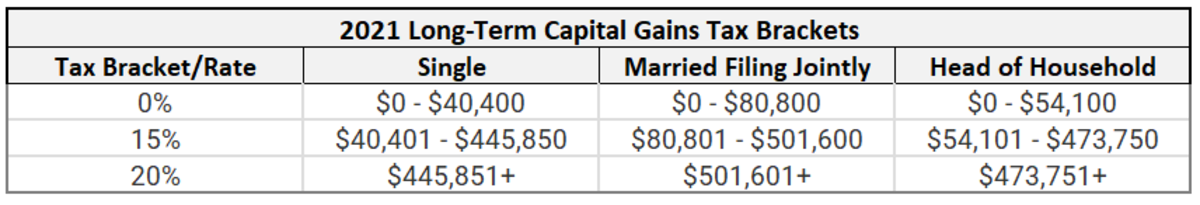

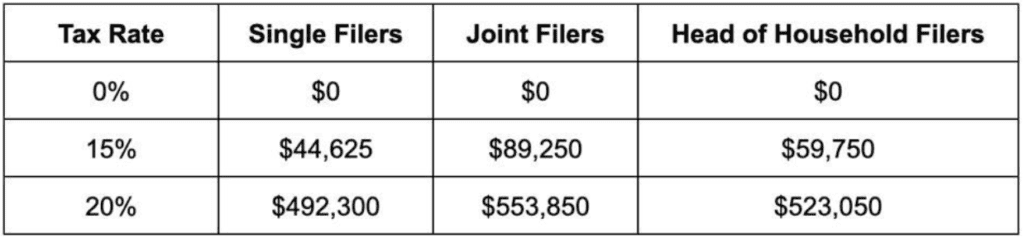

(a) Married individuals filing joint returns and surviving spouses. 2021-45) Year 2021 Inflation-Adjusted Tax Tables and 'Kiddie Tax' (Rev. 2022-38) Year 2022 Inflation-Adjusted Tax Tables and 'Kiddie Tax' (Rev. Year 2023 Inflation-Adjusted Tax Tables and 'Kiddie Tax' (Rev.

0 kommentar(er)

0 kommentar(er)